Table of Content

If you file bankruptcy after an eviction notice has been served, you can add 30 more days to your foreclosure timeline. By contrast, if you file bankruptcy after the foreclosure sale, but before the eviction, your eviction will be put on hold when you file your bankruptcy petition because of the automatic stay. If your house is in foreclosure, bankruptcy can help you live in your house longer. The addition of time to your foreclosure timeline depends on when you file your bankruptcy petition and how far your foreclosure process has advanced. When you file a bankruptcy petition, you will benefit from the protections of an automatic stay. That means that a stop is put in place on all collection activity, including foreclosures, generally until the bankruptcy case is resolved.

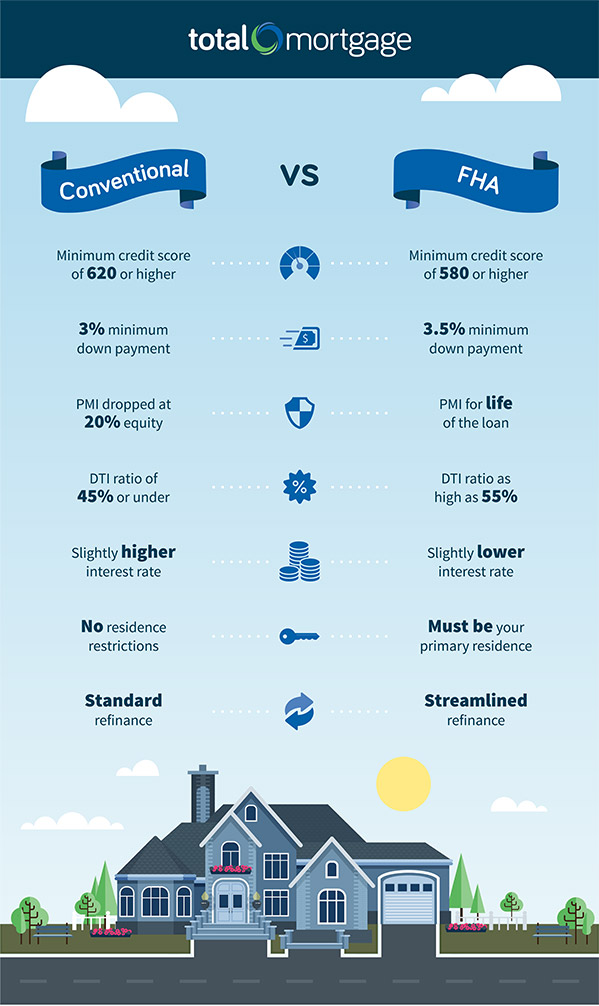

When you believe you're ready to buy a home again, check your credit report and credit score to make sure you're in good shape. Then, shop around to compare mortgage terms, including interest rates, closing costs and fees. Working with a mortgage broker can also help you find the best loan terms for your situation. When considering your mortgage application, lenders look at your debt-to-income ratio—how much monthly debt you have relative to your income.

Most Popular VA Loans articles

If youre being forced to sell due to a maturity event, stay in contact with your lender to prove youre actively trying to sell your home. If your lender thinks youre not actively trying to sell after a maturity event, they may take action, like starting foreclosure proceedings. Your heirs will receive any money that remains after the home is sold.

If all of your other credit obligations are kept in good standing, your FICO score can rebound in as little as two years. But what can other boomerang buyers - those who lost a home to foreclosure and are ready to buy again - do if they want to get a home loan before seven years after a foreclosure? There are some options, though they include paying a premium in interest and a down payment. Pay down your outstanding debt to increase your chances of a mortgage approval. As a general rule of thumb, your total DTI ratio, including your new mortgage payment and all monthly debts, shouldnt exceed 43%. Also, court permission, and proof of satisfactory bankruptcy payment and performance.

VA Loan Eligibility After Foreclosure

Now when I say purchase a home, I mean doing so with the aid of a mortgage; obviously you can buy a house with cash at any time if you’ve got it on hand. In some circumstances, you could qualify for a new mortgage two or three years after a foreclosure. You can take out a traditional mortgage on your home to finance the reverse mortgage. Money's Top Picks Best Personal Loans Over 170 hours of research determined the best personal loan lenders. Current Mortgage Rates Up-to-date mortgage rate data based on originated loans.

Conventional mortgage loans follow rules set by the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation . You'll have to go through a mandatory seven-year waiting period after foreclosure before you can get a Fannie Mae- or Freddie Mac-backed loan. The FHA rules state that you must wait at least 3 years before you are eligible for a FHA loan.

How long after foreclosure can you buy a house?

Foreclosures are not as rare as they once were, and a larger number of consumers now have a foreclosure on their credit reports. After you recover from losing a home that you couldn’t afford, you might want to buy again. As long as you’ve worked hard to pay your bills on time and protect your credit since your foreclosure, getting a home loan isn’t impossible.

Depending on the circumstances, Freddie Mac requires a score of 620 or 660 for a single-family primary residence. You are free to sell your reverse mortgage house in Lexington, KY at will because you retain the property title. Its essential to know your homes current value before selling it because if you continue with the sale, your reverse mortgage becomes due. Your homes current value should be enough to pay the loan and cover the closing costs. Non-judicial foreclosure doesn’t involve the courts; it's still a legal process but is quicker and cheaper than a judicial foreclosure. In some states, the borrower may not have the right of redemption at all.

They'll also examine your credit utilization ratio, or how much of your available credit card you're currently using. Aim to pay down debt and keep your credit card balances—both on each card, and in total—below 30% of your available credit line. It will depend on the lender’s minimum credit score requirement, which often is around 620. Non-prime loans do not require any waiting period after a foreclosure.This means that you may be able to get a new mortgage even just 1 day after a foreclosure.

So if you want to get back out there, here’s how to get a mortgage after foreclosure. Veterans can get a loan guaranteed by the Veterans Administration two years after a foreclosure. However, if they had a foreclosure on a VA loan to begin with, they may not be eligible for another one, Schachter says.

With a reverse mortgage, there are no monthly payments, so the reasons for foreclosure are different. Communicating with your lender is always the best course of action since most lenders are willing to cooperate with borrowers to avoid the costly, time-consuming foreclosure process. “For a conventional mortgage, a borrower who experienced foreclosure is required to wait seven years,” says Ray Rodriguez, regional sales manager at TD Bank. The average loan to value is 77 percent, with a 23 percent average down payment of $50,000 to $60,000. The Federal Housing Administration, or FHA, has a three-year wait for foreclosures. The funding fee of 1.75 percent of the loan amount is rolled into the FHA loan, which goes to the FHA, Schachter says.

Someone with a foreclosure a year ago who has a credit score of at least 550 and has an otherwise clean credit history can get a loan, says Privlo founder Michael Slavin. FHA mortgage insurance premiums dropped in January to .85 percent for 30-year fixed loans up to $417,000. The sticking point, however, is that FHA loans require mortgage insurance for the life of the loan. When you have a deed in lieu of a foreclosure, you are transferring the title of your property to your lender to be released of your loan obligation and to avoid foreclosure.

The rules for getting a conventional mortgage after you have foreclosed is that you wait 7 years. However, if there were “extenuating circumstances”, such as a job loss, or something else out of your control, this may be reduced to only 3 years. For borrowers who are not in as big of a hurry, it would be worth waiting until you are eligible for a conventional or government-backed loan . The waiting periods are longer than they are with non-prime loans, but the loan terms are better .

No comments:

Post a Comment